Get the latest climate technology news directly to your inbox.

Unpacking UAMPS’ plan to replace NuScale’s low-carbon power

Gas will make up part of the generation shortfall that the Mountain West power group faces after canceling its small modular reactor project.

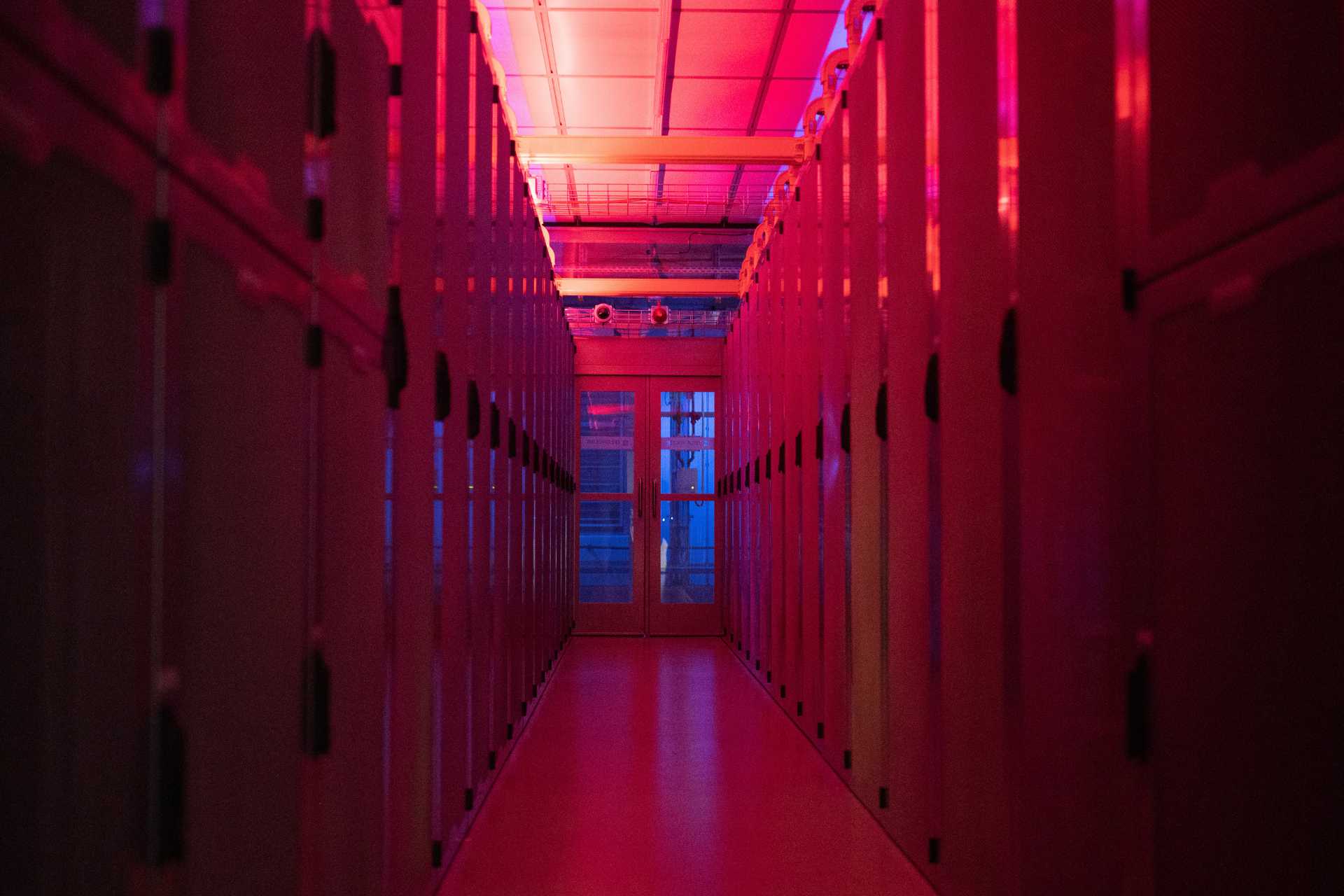

Photo credit: UAMPS

Photo credit: UAMPS

Gas will make up part of the generation shortfall that one power group that serves municipalities in the Intermountain West faces after canceling a high-profile nuclear project in November — despite having an integrated resource plan that supposedly prioritizes clean energy.

- The top line: Utah Associated Municipal Power Systems dealt a blow to the U.S. advanced nuclear industry when it axed plans for the small modular reactor — as the only design so far to gain U.S. Nuclear Regulatory Commission certification, the NuScale project would have been the first of its kind in the country. However, it also left the power group with a 462-megawatt shortfall in future power provision, one that it is now looking to address.

- The nuts and bolts: UAMPS confirmed it expects to fill the power generation gap with an expansion of its Horse Butte wind farm, new utility-scale solar projects, geothermal resources, battery storage, and natural gas plants “that have the ability to use alternate fuel such as hydrogen as such fuel becomes available.”

- The big picture: As energy companies pursue energy transition strategies, they are having to make choices about which technologies will work in the real world -–- and for now nuclear remains a risky proposition compared to wind, solar, and, despite its emissions, gas. While municipal utilities are often able to make more ambitious bets on new or unproven technology than their investor-owned counterparts, in this case UAMPS had to reconsider.

UAMPS is a non-profit agency that provides wholesale electricity to 50 community-owned power systems in seven states throughout the Intermountain West. The power group operates 16 power supply, transmission, and energy services projects that give its members access to 457 megawatts of coal and gas-fired generation, against a total system demand of almost 1.3 gigawatts. According to its 2023 annual report, 28 of its members draw on these fossil fuel plants. (A further 369 megawatts of coal generation, linked to the San Juan Generating Station in New Mexico, was retired in 2022.)

The annual report says UAMPS has developed an integrated resource plan that emphasizes the pursuit of carbon-free power sources, although it does not mention specific decarbonization goals.

However, agency spokesperson Jessica Stewart told Latitude Media that its priority is to “emphasize a prudent transition, avoiding premature shutdowns of fossil-fuel generation until clean energy is reliably sustaining the grid and powering our communities.”

In the wake of the SMR cancellation, UAMPS will instead “be focusing on mature technologies and projects that are already in the works,” added Stewart. “UAMPS still believes that nuclear will be pivotal in providing carbon-free dispatchable power, but the unknown risks associated with the first-of-a-kind project impacted prospective subscribers.”

Before it was canceled, 26 UAMPS members had opted to participate in the SMR (known as the Carbon Free Power Project, or CFPP) — and some of them were already planning new gas generation capacity as well. Idaho Falls Power, for instance, gets 86% of its energy from hydro and most of the remainder from nuclear and wind; the municipal utility had signed up to the CFPP but is also developing a 12-megawatt gas plant.

“CFPP was for baseload, which didn't help our peak needs in winter and summer along with capacity needs for resource adequacy requirements,” Idaho Falls Power general manager Bear Prairie said.

The projects were not in competition with each other, he added; it was not a “one or the other situation.” Idaho Falls Power is now exploring geothermal power to replace the CFPP as a carbon-free baseload generation resource, Prairie added.

The decision to cancel the CFPP was mutual between NuScale and UAMPS and there was no single trigger or utility that prompted the cancellation, Prairie said.

‘Ample time’

In canceling the project, UAMPS essentially traded the potential for dramatic emissions cuts — and the first-SMR bragging rights — for the relative certainty of familiar power sources. While new gas generation will be a detriment to the energy transition, it seems clear that UAMPS’ members felt it was too risky to bet so much low-carbon generation on a project with an untested technology. With a delivery date of 2029, any delays or overruns would have left UAMPS’ low-carbon plans badly off track.

The exact makeup of the replacement generation mix has yet to be decided, Stewart confirmed.

“Because the project delivery date for the CFPP was December 2029, UAMPS has ample time and opportunity to replace the energy output,” said Stewart, adding that the time allows UAMPS to focus on diversifying its energy portfolio. Following the termination of the CFPP, the group’s future generation plans sound a lot like those of many other utilities across the U.S. Hence, the cancellation of the project would appear to have little impact on UAMPS members.

The same cannot be said for NuScale and the wider nuclear industry, though. SMRs are widely viewed in U.S. nuclear circles as the sector’s last chance to compete in the energy transition, but the technology’s path to commercialization has proved challenging.

NuScale is known to be pursuing further development opportunities, and in November 2023 announced plans to develop two SMRs for Standard Power, a New York-based data center services company.

But earlier this month, two months after losing the CFPP, NuScale laid off 28% of its employees. The company did not respond to a request for comment.

.png)