Get the latest climate technology news directly to your inbox.

Data center construction is rising to meet demand

But regions like Salt Lake City and Atlanta are seeing particularly dramatic growth — and more energy load along with it.

A new Facebook data center under construction. Photo credit: George Frey / AFP via Getty Images

A new Facebook data center under construction. Photo credit: George Frey / AFP via Getty Images

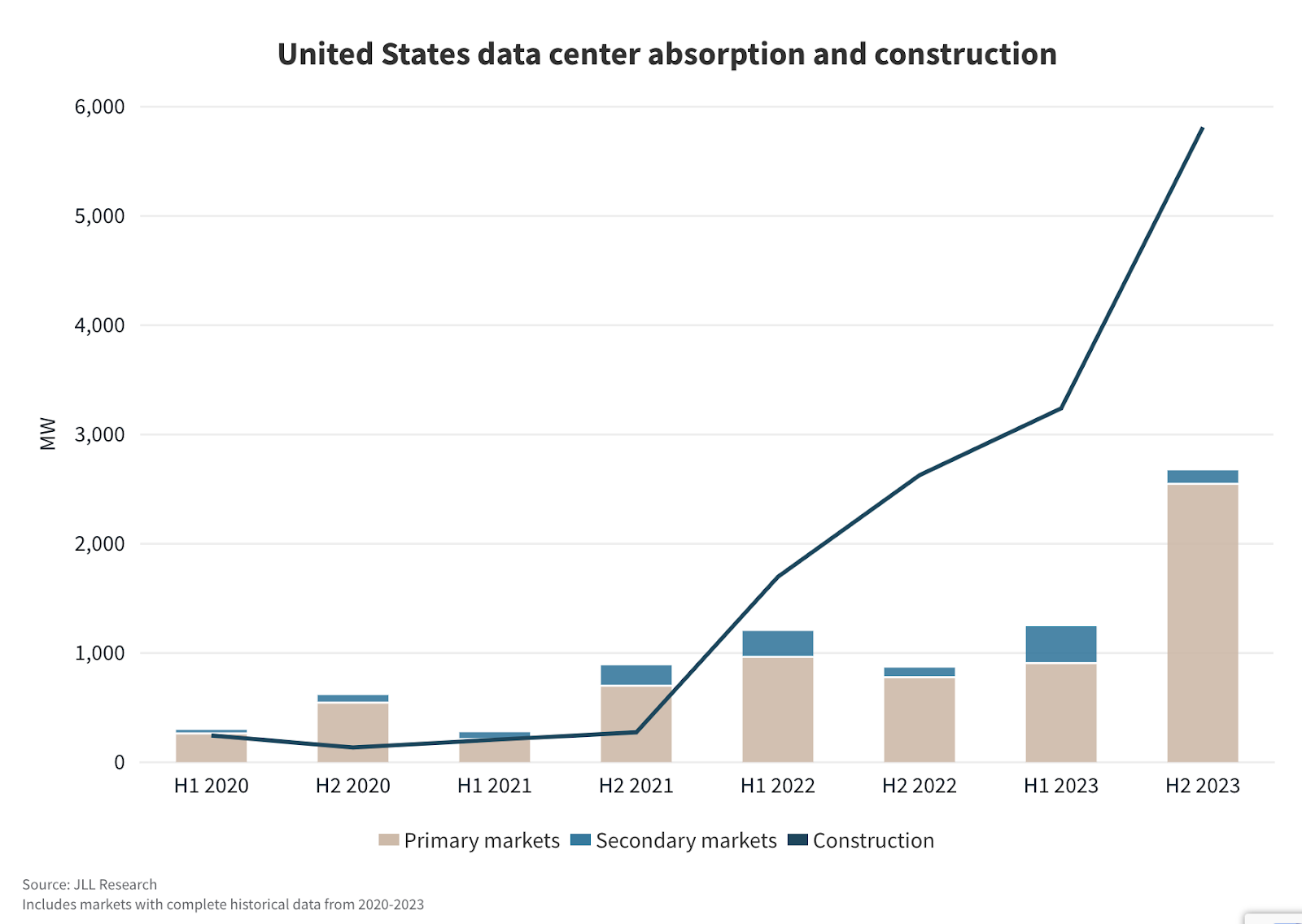

In light of the rise of artificial intelligence, the demand for data center capacity soared in 2023. And — much to the alarm of many who read the International Energy Agency’s recent report on the subject — its dramatic growth is only expected to continue.

But new data suggests that construction of new capacity has already begun the race to catch up. And that means significant new load for the grid is just around the corner.

- The top line: A new report from the real estate services company JLL found that North America had 5.3 gigawatts of new data center capacity under construction by the second half of 2023, which amounts to “enough energy to power all the households in the San Francisco metro area for one year.” But certain regions, including Atlanta and Salt Lake City, are seeing more than their share of construction, and of the energy load growth that comes with it.

- The market grounding: The energy demands of AI are undoubtedly huge, and have led to correspondingly huge anxiety about the climate implications of the data centers needed. Experts are mixed on the true scope of the problem, though, citing the inherent uncertainty in how data centers will evolve — operational improvements like orchestration could make the sector far more energy efficient, for instance. For now, though, the JLL report makes clear that the sector is already responding to the growth in demand, and its energy use is too.

JLL found that the accelerating demand for data centers accelerated last year prompted 3.4 GW of transactions across the most popular markets in North America.

According to the IEA, total data center energy demand globally could reach 1,000 terawatt-hours by 2026; a more conservative estimate from Schneider Electric found it could reach around 800 TWh by 2028. (However, the latter doesn’t mention loads from crypto, so the two are not perfectly comparable.) And demand is only growing — and faster in some places than in others.

The sector has already begun to meet the moment, the report found, almost doubling the megawatts of capacity under construction across both primary and secondary markets.

Of the country's most popular markets, North Virginia had the most megawatts under construction, but Atlanta's growth was most dramatic; the region will more than double its current capacity with the construction underway in the latter half of the year.

But limited capacity in primary markets meant that more of that construction, almost 20%, took place in secondary markets like Salt Lake City, the Austin/San Antonio area, and the Las Vegas/Reno Area. Salt Lake City in particular saw huge growth in capacity — the fastest acceleration in all of North America — which JLL attributed to its low power and gas costs as well as its increased popularity as a tech sector hub.

Are growing concerns over AI’s power demand justified? Hear from Latitude Media's Stephen Lacey and industry-leading experts as they address the energy needs of hyperscale computing, driven by artificial intelligence.

.png)

Are growing concerns over AI’s power demand justified? Hear from Latitude Media's Stephen Lacey and industry-leading experts as they address the energy needs of hyperscale computing, driven by artificial intelligence.

.png)

Are growing concerns over AI’s power demand justified? Hear from Latitude Media's Stephen Lacey and industry-leading experts as they address the energy needs of hyperscale computing, driven by artificial intelligence.

.png)

Are growing concerns over AI’s power demand justified? Hear from Latitude Media's Stephen Lacey and industry-leading experts as they address the energy needs of hyperscale computing, driven by artificial intelligence.

.png)

The bulk of capacity poised to come online this year has already been leased; in primary markets, space in data centers is unlikely to open up for at least two years, JLL found.

Data center companies are also beginning to upgrade and expand existing infrastructure, as well as develop new centers focused specifically on matching the AI load profile.

“New AI-focused data centers do not require backup power or as much redundancy as traditional enterprise data centers and can occupy a smaller physical footprint but require significantly more power,” the report found.

The cost of operating data centers is also soaring, in part due to increasing power costs. Primary markets saw power rates increase by an average of 15.6% from 2023, and secondary markets by an average of 9%.

This is due to a confluence of factors: a growing demand for power from electrified buildings and vehicles, as well as growing demand for power from manufacturing sectors and, of course, data centers. These developments require utilities to invest in upgrades, the report said, the cost of which often end up being passed on to the end user in the form of rising rates.

However, rates began to stabilize toward the end of 2023, and are expected to remain stable in 2023, JLL concluded.

.jpg)